membersCompany’s annual board term and typical market practice. Restricted shares granted prior to November 2019 vest in three equal installments on the first, second and third anniversaries of the grant date; restricted shares granted to independent directors after November 2019 will vest on the first anniversary of such grant date.Travel Reimbursement

All independent directors are reimbursed for the reasonable travel expenses they incur in attending meetings of the Board or Board committees.

Stock Ownership Requirement

Directors are kept informedrequired to hold an amount of the Company’s common stock equal to two times the annual cash retainer of $70,000, which amount may be accumulated over five years. As of December 31, 2020, all directors have achieved this threshold.

2020 DIRECTOR COMPENSATION TABLE

The following table provides compensation information for our directors for Fiscal 2020 except for Mr. Clark, our President and Chief Executive Officer. Compensation earned by Mr. Clark for Fiscal 2020 is included in the Summary Compensation Table on page 51 of this proxy statement.

| Name | | Fees Earned

or Paid in

Cash ($)(1) | | Stock

Awards

($)(2)(3)(4) | | Total ($) |

| W. Larry Cash | | 84,000 | | 110,000 | | 194,000 |

| Thomas C. Dircks | | 108,500 | | 110,000 | | 218,500 |

| Gale Fitzgerald | | 56,000 | | 110,000 | | 166,000 |

| Darrell S. Freeman, Sr. | | 49,000 | | 110,000 | | 159,000 |

| Janice E. Nevin, M.D., MPH | | 49,000 | | 110,000 | | 159,000 |

| Mark Perlberg, JD | | 49,000 | | 110,000 | | 159,000 |

| Joseph A. Trunfio, Ph.D. | | 59,500 | | 110,000 | | 169,500 |

| (1) | On March 23, 2020, fees became payable on a quarterly basis. Thereafter, the Board of Directors unanimously agreed to reduce their quarterly cash compensation payments by 10% in response to the COVID-19 pandemic. Normal quarterly payments resumed in October 2020 as the Company’s financial performance continued to stabilize and improve. |

| (2) | Amounts in this column reflect the aggregate grant date fair value of awards of restricted stock granted under our 2020 Omnibus Incentive Plan and computed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 718, Compensation-Stock Compensation (ASC Topic 718). The assumptions used in determining the amounts in this column are set forth in Note 15 to our consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on February 25, 2021. The aggregate grant date fair value per share of restricted stock granted on June 1, 2020 was $6.14. The restricted stock granted on June 1, 2020 will vest on the first anniversary of their grant date. Based on a grant date fair value of approximately $110,000, the actual number of shares of restricted stock granted to each director was 17,916 shares. |

| (3) | Aggregate restricted shares outstanding as of December 31, 2020 for each director were as follows: W. Larry Cash: 31,236; Thomas C. Dircks: 31,236; Gale Fitzgerald: 31,236; Darrell S. Freeman, Sr.: 30,805; Janice E. Nevin: 17,916; Mark Perlberg: 31,236; and Joseph A. Trunfio: 31,236. |

| (4) | In November 2019, the Governance and Nominating Committee modified its Guidelines to provide for accelerated vesting of stock grants to an independent director upon retirement so long as the director was at least 70 years old or has served on the Board for 7 years. |

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of March 18, 2021, regarding the beneficial ownership of our businessCommon Stock by various documents senteach person who is known by us to them before each meeting and as otherwise requested, as well as through oral reports made to them during these meetings bybe the beneficial owner of 5% or more of our Common Stock, our Chief Executive Officer, Chief Financial Officer and the three most highly compensated persons (other than the CEO and CFO) who were serving as executive officers at December 31, 2020, each of our directors and director nominees, and all directors and executive officers as a group. The number of shares of Common Stock beneficially owned by the Company’s directors and named executive officers and all directors and executive officers as a group includes shares of Common Stock they have the right to acquire within 60 days of March 18, 2021. The percentages in the last column are based on 37,512,543 shares of Common Stock outstanding on March 18, 2021, plus the number of shares of Common Stock deemed to be beneficially owned by such individual or group pursuant to Rule 13d-3(d)(1) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. In each case, except as otherwise indicated in the footnotes to the table, the shares shown in the second column are owned directly by the individual or members of the group named in the first column and such individual or group members have sole voting and dispositive power with respect to the shares shown. For purposes of this table, beneficial ownership is determined in accordance with federal securities laws and regulations. Persons shown in the table disclaim beneficial ownership of all securities not held by such persons directly and inclusion in the table of shares not owned directly by such persons does not constitute an admission that such shares are beneficially owned by the director or officer for purposes of Section 16 of the Exchange Act or any other senior executives;purpose.

| Name | Number of Shares

of Common Stock

Beneficially Owned | Percentage of

Outstanding

Common

Stock Owned |

BlackRock Inc. 55 East 52nd Street New York, NY 10055 | 5,436,060 | (a) | 14.5% |

Aristotle Capital Boston, LLC One Federal Street, 36th Floor Boston, MA 02110 | 2,473,371 | (b) | 6.6% |

T Rowe Price Associates Inc. 100 E. Pratt Street Baltimore, MD 21202 | 2,457,589 | (c) | 6.6% |

Vanguard Group 100 Vanguard Blvd Malvern, PA 19355 | 2,232,415 | (d) | 6.0% |

Systematic Financial Management 300 Frank W. Burr Blvd. Glenpointe East, 7th Floor Teaneck, NJ 07666 | 2,100,084 | (e) | 5.6% |

Dimensional Fund Advisors, LP Building One 6300 Bee Cave Road | | | |

| Austin, TX 78746 | 1,890,229 | (f) | 5.0% |

| Susan E. Ball | 213,805 | (g) | * |

| William J. Burns | 253,976 | (h) | * |

| W. Larry Cash | 170,870 | (i) | * |

| Kevin C. Clark | 527,665 | (j) | 1.4% |

| Thomas C. Dircks | 182,988 | (k) | * |

| Gale Fitzgerald | 145,972 | (l) | * |

| Darrell S. Freeman, Sr. | 49,984 | (m) | * |

| Janice E. Nevin, M.D., MPH | 17,916 | (n) | * |

| Mark Perlberg, JD | 66,544 | (o) | * |

| Stephen A. Saville | 63,548 | (p) | * |

| Joseph A. Trunfio, Ph.D. | 188,422 | (q) | * |

| Buffy S. White | 65,315 | (r) | * |

| All directors and executive officers as a group (17 individuals) | 2,084,887 | | 5.6% |

| (a) | The information regarding the beneficial ownership of shares by BlackRock, Inc. was obtained from its statement on Schedule 13G/A, filed with the SEC on January 26, 2021. Such statement discloses that BlackRock, Inc. has sole voting power of 5,402,797 shares and has sole dispositive power of 5,436,060 shares. |

| (b) | The information regarding the beneficial ownership of shares by Aristotle Capital Boston, LLC was obtained from its statement on Schedule 13G, filed with the SEC on February 2, 2021. Such statement discloses that Aristotle Capital Boston, LLC has sole voting power of 1,382,171 shares and sole dispositive power of 2,473,371 shares. |

| (c) | The information regarding the beneficial ownership of shares by T Rowe Price Associates Inc. was obtained from its statement on Schedule 13G/A, filed with the SEC on February 16, 2021. Such statement discloses that T Rowe Price Associates Inc. possesses sole voting power over 549,525 shares and sole dispositive power over 2,457,589 shares. |

| (d) | The information regarding the beneficial ownership of shares by Vanguard Group Inc. was obtained from its statement on Schedule 13G/A, filed with the SEC on February 12, 2021. Such statement discloses that Vanguard Group Inc. possesses shared voting power over 29,214 shares, sole dispositive power over 2,193,884 shares, and shared dispositive power over 38,531 shares. |

| (e) | The information regarding the beneficial ownership of shares by Systematic Financial Management, LP was obtained from its statement on Schedule 13G, filed with the SEC on February 12, 2021. Such statement discloses that Systematic Financial Management, LP possesses sole voting power over 1,317,134 shares and sole dispositive power over 2,100,084 shares. |

| (f) | The information regarding the beneficial ownership of shares by Dimensional Fund Advisors LP was obtained from its statement filed on Schedule 13G/A, filed with the |

SEC on February 12, 2021. Such statement discloses that Dimensional Fund Advisors LP possesses sole voting power over 1,802,784 shares and sole dispositive power over 1,890,229 shares.

| (g) | Includes 73,858 shares of Restricted Stock. |

| (h) | Includes 123,426 shares of Restricted Stock. |

| (i) | Includes 31,236 shares of Restricted Stock. |

| (j) | Includes 385,865 shares of Restricted Stock. |

| (k) | Includes 31,236 shares of Restricted Stock. |

| (l) | Includes 31,236 shares of Restricted Stock. |

| (m) | Includes 30,805 shares of Restricted Stock. |

| (n) | Includes 17,916 shares of Restricted Stock. |

| (o) | Includes 31,236 shares of Restricted Stock. |

| (p) | Includes 53,413 shares of Restricted Stock. |

| (q) | Includes 31,236 shares of Restricted Stock. |

| (r) | Includes 50,000 shares of Restricted Stock. |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis is designed to provide our Board structure providesstockholders with a clear understanding of our compensation philosophy and objectives, compensation-setting process, and the compensation paid to our named executive officers, or NEOs, in Fiscal 2020. As discussed in Proposal No. 3, we are conducting a Say-on-Pay vote this year that requests your approval, on an advisory basis, of the compensation of our NEOs as described in this section and in the tables and accompanying narrative.

Our NEOs for Fiscal 2020, which consist of our principal executive officer, our principal financial officer, and our three other most highly compensated executive officers, are:

| Name | | Position |

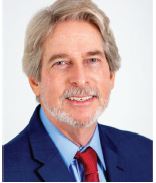

| Kevin C. Clark | | Chief Executive Officer and President |

| William J. Burns, MBA, CPA | | EVP, Chief Financial Officer and Principal Accounting Officer |

| Susan E. Ball, JD, MBA, RN | | EVP, Chief Administrative Officer, General Counsel and Secretary |

| Stephen A. Saville, JD | | Group President, Locums, Education and Corporate Development |

| Buffy S. White | | Group President, Workforce Solutions |

Business Description

We are a leader in providing total talent management including strategic workforce solutions, contingent staffing, permanent placement, and consultative services for healthcare customers. Leveraging our 35 years of industry expertise and insight, we solve complex labor-related challenges for customers while providing high-quality outcomes and exceptional patient care. As a multiyear Best of Staffing® Award winner, we are committed to an exceptionally high level of service to both our clients and our healthcare professionals. We were the first publicly traded staffing firm to obtain The Joint Commission Certification, which we still hold with a Letter of Distinction. In February 2021, we earned Energage’s inaugural 2021 Top Workplaces USA award. We have a longstanding history of investing in our diversity, equality, and inclusion strategic initiatives as a key component of our overall corporate social responsibility program which is closely aligned with our core values to create a better future for our people, communities, the planet, and our shareholders.

Fiscal 2020 Business Performance Highlights

During 2020, we completed our turnaround strategy. Specifically, we achieved the following during Fiscal 2020:

| - | Invested in revenue producing capacity, realigned and optimized our teams, reduced overhead by more than $20 million annually, permanently closed more than 50 offices (primarily local staffing while maintaining a local presence), implemented and successfully deployed an integrated cloud-based platform connecting our recruiters, account managers, and sales teams to enhance productivity, and launched Cross Country Marketplace, our proprietary on-demand mobile app for local market staffing. |

| - | Our 2020 full year financial results once again demonstrated our ability to execute well across multiple fronts, including expanding our base of clinicians on assignment against a backdrop of strong demand. We delivered consolidated revenue growth for the full year of 2%, despite school closures impacting our education business and other impacts from COVID-19 on our local and physician staffing businesses. For the first time in five years, we exceeded our profitability targets which resulted in awards earned above 100% of target levels consistent with our pay-for-performance philosophy. The 2018 performance stock awards were also forfeited in conformance with our pay-for-performance policy. |

| - | Along with solid execution on fulfillment and delivery, we continued on our path of digital innovation with the expansion of a cloud based platform that connects recruiters, account managers and the sales team for the entire travel nurse and allied teams, as well as the deployment of our proprietary on-demand mobile app, Cross Country Marketplace, to all of our local markets. |

| - | We also continued to make investments in social initiatives and diversity, including by electing another woman to our Board of Directors in May 2020. The Company is proud to have sponsored nursing scholarships at Florida Atlantic University and we were the presenting sponsor of the Leukemia and Lymphoma Society “Light the Night” walk -- just to mention a few. |

Our Response to COVID-19

2020 was a challenging year due to the COVID-19 pandemic, yet a very rewarding year as we saw the best in our people and have been able to help heal the nation patient by patient. At the outset of the pandemic, we committed to adhering to our core values and beliefs by always striving to “do the right thing” for our clients, nurses, communities, employees and stockholders, and by taking a collaborative approach to problem-solving.

In March 2020, we quickly moved to a remote work environment and established protocols aligned with recommendations from the Centers for Disease Control to protect our corporate employees and front-line professionals. As thousands of our healthcare professionals were on the front-lines, we also established a robust support system for those workers, providing access to a 24/7 hotline for healthcare workers who are experiencing emotional stress, and other resources to help them during a difficult time. During 2020, we responded to nearly 11,000 hotline calls and have aspired to be constant advocates for our healthcare professionals. Perhaps most importantly, we delivered on our value proposition, serving as an integral partner in redistributing the supply of healthcare labor where it was needed most during an unprecedented crisis throughout the country. This was poignantly displayed in a video sent to us by one of our long-time valued clients, showing our nurses receiving a standing ovation as they arrived at the hospital to bring relief to an exhausted staff.

Overall, we outperformed financially in 2020, significantly improving profitability in an extraordinarily challenging environment and positioning the Company for long-term value creation going forward. The crisis resulted in us returning to our roots as an entrepreneurial, innovative company, building an exceptional team of professionals and embracing technology in new and exciting ways. Despite the pandemic, we executed well across multiple fronts, including:

| ● | Rapidly expanding our base of clinicians on assignment against a backdrop of rising demand |

| ● | Taking decisive action to significantly reduce costs, including the closure of more than 50 brick-and-mortar offices |

| ● | Furthering our digital transformation strategy and reaching key milestones set in our 5-year strategic plan: |

| ○ | Completing the implementation of our integrated, cloud-based Applicant Tracking System for key segments, laying the foundation for a digital ecosystem on one end-to-end platform to improve both productivity and the candidate experience. |

| ○ | Launching phase one of our proprietary on-demand mobile app, Cross Country Marketplace, to our entire local footprint. |

| ○ | Executing the operationalization of our cloud-based CRM to more effectively engage prospective and manage existing client relationships. |

| ○ | Introducing an enterprise business analytics tool to accelerate top and bottom-line revenue growth through adaptive market positioning, leveraging real time AI and machine learning. |

| ○ | Institutionalizing sophisticated digital media strategies to source, engage and efficiently place high quality healthcare professionals faster. |

Through all of these changes, our team remained focused and continued to uphold our values and our standards of excellence while working to improve the financial performance of the company, advocating for our healthcare professionals and providing consultation and staffing to our clients.

COMPENSATION PHILOSOPHY AND OBJECTIVES

| What we do | What we don’t do |

| ☑ | Majority of compensation incentive-based and at risk tied to company performance | X | No guaranteed incentive payments |

| ☑ | Engage independent compensation consultants | X | No 280G excise tax gross-ups |

| ☑ | Engage in peer group benchmarking | X | No supplemental executive pension or retirement plans |

| ☑ | Due diligence in setting compensation targets and goals | X | No option repricing |

| ☑ | Periodically assess the compensation programs to ensure that they are not reasonably likely to incentivize employee behavior that would result in any material adverse risks to the company | X | Perquisites are not a substantial portion of our NEO pay packages |

| ☑ | Provide reasonable severance protection with double trigger protections upon a change in control | X | No pledging and no hedging |

| ☑ | Clawback of equity and cash incentive payments in the event of a restatement | | |

| ☑ | Robust stock ownership guidelines: Directors (2x cash component); CEO (3x Base Salary); and Other Senior Executives (1x Base Salary) | | |

The philosophy of our executive compensation program is to align pay with performance, keep overall compensation competitive and ensure that we can recruit, motivate and retain high quality executives. Accordingly, our executives’ compensation is heavily weighted toward compensation that is performance-based or equity-based. Our NEO compensation for Fiscal 2020 reflects this commitment.

The Compensation Committee structured the Fiscal 2020 executive compensation with the goal of ensuring that total direct compensation levels were sufficiently competitive to attract, motivate and retain the highest quality executives, that performance-based “at-risk” incentive compensation was a substantial portion of total compensation opportunities, and that long-term incentive compensation aligned executives’ interests with our stockholders’ interests to create long-term stockholder value. The Compensation Committee structured the Fiscal 2020 equity incentive to retain key executives. In addition, the Compensation Committee also structured the equity incentive to take into account the Company’s near-term and longer-term strategic objectives to provide executives with the opportunity to acquire a significant stake in our growth and prosperity. It was also structured to incentivize and reward executives for sound business management,

developing a high performance team environment, fostering the accomplishment of strategic and operational objectives, and compensating executives for improvement in stockholder value, all of which are essential to improving our financial performance and creating success.

Our executives’ compensation for Fiscal 2020 consisted of a base salary, an annual incentive bonus and long-term equity awards (66.7% of which are time vested over three years and 33.3% of which are performance-based). The Compensation Committee increased the weighting on performance-based equity from 25% of target award opportunities in Fiscal 2019 to 33.3% in Fiscal 2020 to further strengthen the alignment of executive pay with long-term sustainable performance. In Fiscal 2020, the performance-based portion of the long-term equity awards was based on two performance metrics: (i) three-year cumulative Adjusted EBITDA (weighted 75%) and (ii) Adjusted EBITDA margin for the third year of the performance period (weighted 25%). For Fiscal 2020, 79% of our CEO’s target total compensation and an average of 63% of our other NEOs’ target total compensation were performance-based or equity-based. We do not provide defined benefit pension, supplemental retirement benefits or executive perquisites to our NEOs as they are not tied to performance.

The three principles of our compensation philosophy are as follows:

| PRINCIPLE | RATIONALE |

| Total direct compensation levels should be sufficiently competitive to attract, motivate and retain the highest quality executives | Our Committee seeks to establish total direct compensation targets (base salary, short-term and long-term incentives) at the 50th percentile of our Peer Group and market data of companies of like size, thereby providing our executives the opportunity to be competitively rewarded for our financial, operational and stock price growth. We believe paying at the 50th percentile is competitive and promotes employment engagement and high performance. It is also the Compensation Committee’s intention to set total executive compensation at sufficiently competitive levels to attract and retain strong, motivated leadership who will not only strive to meet and exceed our key operating and strategic objectives, but also demonstrate the utmost integrity in doing so. |

| Performance-based compensation should constitute a substantial portion of total compensation | We believe in a pay-for-performance culture, with a significant portion of total direct compensation being performance-based and/or “at risk.” The performance of our executives, considered in light of general economic and specific company, industry and competitive conditions, serves as the primary basis for determining their overall compensation. Accordingly, a portion of the compensation provided to our executive officers is tied to, and varies with, our financial and operational performance, as well as individual performance. We view our short-term and long-term incentive components of the compensation program as being variable and “at risk.” |

| Long-term incentive compensation should align executives’ interests with our stockholders’ interest to further the creation of long-term stockholder value | Awards of equity-based compensation encourage executives to focus on our long-term growth and prospects and incentivize executives to manage the Company from the perspective as owners with a meaningful stake, and to encourage them to remain with us for long and productive careers. Our stock ownership guidelines further enhance the incentive to create long-term stockholder value. Equity-based compensation also subjects our executives to market risks similar to our stockholders. |

This philosophy serves as the basis of the Compensation Committee’s decisions regarding each of the following three components of pay, each of which is discussed below:

| ● | short-term (annual) incentive compensation; and |

| ● | long-term (equity) compensation. |

Consideration of Stockholder Advisory Vote

As part of its compensation setting process, the Compensation Committee also considers the results of the prior year’s advisory vote by our stockholders on our executive compensation to provide useful feedback regarding whether our stockholders believe the Compensation Committee is achieving its goal of designing an executive compensation program that promotes the best interests of the Company and its stockholders by providing its executives with the appropriate compensation and meaningful incentives. For the ninth straight year, our executive compensation program received substantial stockholder support and was approved, on an advisory basis, by 96% of the votes cast at the 2020 annual stockholder meeting. Our Compensation Committee believes that this vote reflected our stockholders’ strong oversightsupport of the compensation decisions made by the Compensation Committee for our NEOs for 2019.

DETERMINATION OF COMPENSATION

Role of the Compensation Committee

The Compensation Committee is composed solely of independent directors and is responsible for determining the compensation of our CEO and other NEOs. The Compensation Committee receives assistance from its independent compensation advisor, Pearl Meyer & Partners, LLC (“Pearl Meyer”).

Our NEO compensation program is implemented yearly during the first quarter, which coincides with the completion of our annual financial statement audit and release of annual earnings, as well as the approval of the budget for the then current year. Annual cash incentives earned for the prior year, if any, are determined by the Compensation Committee and paid out at that time. Current year target objectives are also established at that time and any adjustments to base salaries are typically determined by the Compensation Committee at that time.

When making NEO compensation decisions, the Compensation Committee takes many factors into account, including the economy, the NEO’s performance, expected future contributions to the Company’s success, the financial and operational results of individual business units, our financial and operational results as a whole, the NEO’s historical compensation, and any retention concerns. As part of the process, the CEO provides the Compensation Committee with his assessment of the other NEOs’ performance and other factors used in developing his recommendation for their compensation, including salary adjustments, cash incentives and equity grant guidelines for the then current year. In looking at historical compensation, the Compensation Committee looks at the progression of salary increases over time, a NEO’s ability to meet performance objectives in prior years, the value inherent in equity awards to be granted to complete the total compensation program for an NEO for a particular because non-management directors meet separately,year, economic outlook and our stock performance. The Compensation Committee uses the same general factors in evaluating the CEO’s performance and compensation as it uses for the other NEOs; provided, however, the CEO does not participate in his own assessment.

Upon receipt of this information, the Compensation Committee discusses proposed compensation plans for the CEO and other NEOs in detail. Based on our Governance Guidelines, the Compensation Committee is required to approve annually the goals and objectives for compensating the CEO and other NEOs, evaluate their performance in light of these goals before setting their salaries, bonus and other incentive and equity compensation. The Compensation Committee adjusts the cash incentive portion of the NEOs’ total target pay mix consistent with its philosophy to incentivize and reward executives to reach certain financial and strategic objectives and reward them based upon their performance. The Compensation Committee believes that maintaining the flexibility to make upward or downward adjustments to the various components of the NEOs compensation programs allows the Compensation Committee to appropriately provide incentives to individuals and further aligns the NEOs with the objectives of our stockholders.

Role of Management

The Compensation Committee and the Board made all decisions regarding the compensation of our NEOs, after considering recommendations from our CEO, who provides the Compensation Committee with his assessment of the other NEOs’ performance and other factors used in developing his recommendation for their compensation, including salary adjustments, cash incentives and equity grant guidelines for the then current year for NEO compensation other than his own.

Role of the Compensation Consultant

Annually, the Compensation Committee evaluates the Company’s executive and director compensation design, competitiveness and effectiveness. For Fiscal 2020, the Compensation Committee continued to engage Pearl Meyer to review the compensation components for our NEOs against our 2020 Peer Group and market data of like-sized companies, assist in the determination of the Fiscal 2020 compensation for our NEOs, and provide recommendations for our director compensation program. The Compensation Committee annually reviews the independence of Pearl Meyer. Pearl Meyer does not perform any other services for the Company other than its compensation consulting services to the Compensation Committee and is adviseddeemed to be independent and conflict-free under relevant stock exchange standards.

Role of Benchmarking

At the beginning of the executive compensation setting process each year, the Compensation Committee, in consultation with its independent compensation consultant, determines the process by which it will work to ensure that the Company’s compensation programs are competitive. For Fiscal 2020, the Compensation Committee, with the recommendation of Pearl Meyer, determined it would be appropriate to maintain the group of peer companies which it had established in 2019. The peer group is composed of companies from both the healthcare staffing and general staffing industry, and it includes the following 10 companies (the “2020 Peer Group”):

| 2020 PEER GROUP |

AMN Healthcare Services, Inc. | Volt Information Sciences, Inc. | Heidrick & Struggles International Inc. |

On Assignment, Inc. | Hudson Global, Inc. | GP Strategies Corp. |

KForce, Inc. | Korn/Ferry International | Barrett Business Services, Inc. |

TrueBlue, Inc. | | |

The Compensation Committee determined that the peer group reflects companies falling within a generally comparable size range that we compete with for business, executive talent, and investor capital.

Although the companies in the 2020 Peer Group are comparable to the Company in certain respects, factors such as revenue, business mix, profitability, business strategy, compensation philosophy, and incentive plan design vary among the peers and such differing factors affect the compensation which they provide to their executives. While informative to the Compensation Committee, such peer practices are not the sole factor that influences the Compensation Committee’s decisions about executive compensation. The Compensation Committee also makes decisions based on the collective experience and knowledge of its members. Generally, our policy has been to pay our NEOs base salaries at the 50th percentile of our 2020 Peer Group.

COMPONENTS OF FISCAL 2020 NEO PAY PROGRAM

The Compensation Committee uses various compensation elements to provide an overall competitive total compensation and benefits package to the NEOs that is tied to creating stockholder value, is commensurate with our financial results and aligns with the business strategy. The Compensation Committee’s specific rationale, design, reward process and relating information are outlined below.

Base Salary

We provide the NEOs with a base salary to compensate them for services rendered during the fiscal year. Base salary ranges for NEOs are determined on the basis of each executive’s position, performance and level of responsibility. Base salary levels are reviewed annually. Peer group and market data from like sized companies are utilized in our review. Merit increases for NEOs are considered based on the annual reviews of market data and base salaries, and are adjusted only as needed, not necessarily annually. Base salaries for NEOs are generally benchmarked within a tight range of the market median for our peer groups and companies of like size.

For Fiscal 2020, none of our NEOs received a base salary increase other than Ms. White, whose salary was increased by 7.5% to more closely align with levels provided to other Group President and senior executive officers. As previously noted, as part of our response to the economic impacts of the COVID-19 pandemic, our NEOs voluntarily agreed to a 10% reduction in base salary, effective as of May 1, 2020 for Mr. Clark and as of July 1, 2020 for other NEOs. Effective October 1, 2020, as Company performance continued to stabilize and improve, base salaries for all actions takenNEOs were restored to pre-cut levels.

| NEO | | | 2020 Base

Salary ($)(1) | | 2019 Base

Salary ($) | | % Increase vs Prior Year |

| Kevin C. Clark | | | 825,000 | | 825,000 | | —% |

| William J. Burns | | | 525,000 | | 525,000 | | —% |

| Susan E. Ball | | | 420,000 | | 420,000 | | —% |

| Stephen A. Saville | | | 430,000 | | 430,000 | | —% |

| Buffy S. White | | | 430,000 | | 400,000 | | 7.5% |

| (1) | | Reflects full annual base salaries prior to temporary 10% reductions, which our NEOs voluntarily agreed to for a portion of 2020 in response to the COVID-19 pandemic. |

Annual Cash Incentive Program

The annual cash incentive program is a core component of our “pay-for-performance” philosophy. The program is heavily weighted to our financial results or relevant business units and the goals are closely linked to business strategy. The components of this program have historically included the incentive and reward opportunity (expressed as a percentage of base salary) and performance measures determined by the various committeesCompensation Committee, such as revenue, Adjusted EBITDA, and segment contribution income. To ensure the integrity of the goals and minimize the risk of unanticipated outcomes, each goal has had a performance range built around it with a commensurate increase or decrease in the associated award opportunity. The Compensation Committee may adjust performance measures for certain special, unusual or non-recurring items at its sole discretion.

Each annual target cash incentive award opportunity is expressed as a percentage of base salary, which may be earned based on both the achievement of certain financial objectives (the “Objective Bonus” component) and individual subjective considerations tied primarily to individual objectives (the “Subjective Bonus” component). If results fall below pre-established

threshold levels, no cash award is payable under the Objective Bonus component, although a Subjective Bonus may still be paid at the discretion of the Compensation Committee. If results exceed pre-established outstanding goals, the cash award payable under the Objective Bonus component is capped at a maximum award opportunity of 180% of the short-term incentive target. The Compensation Committee believes that having a maximum cap serves to promote good judgment by the NEOs, reduces the likelihood of windfalls and makes the maximum cost of the plan predictable. The award opportunity is established for each position with the desired emphasis on pay at risk (more pay at risk for senior executives) and internal equity (comparably positioned executives should have comparable award opportunities).

The Subjective Bonus opportunity also is capped at a maximum amount, expressed as a percentage of the short-term incentive target, which may vary for each position. The use of subjective criteria enables the Compensation Committee to consider a variety of subjective factors relative to each executive’s specific responsibilities. This process allows the Compensation Committee to evaluate performance and to recognize contributions in light of our changing needs and strategic priorities.

Incentive payouts under the Annual Cash Incentive Program, at a reduced level, begin upon achievement of a predetermined percentage of targeted objectives (generally 80% or higher for EBITDA and 95% for revenue) which can vary from year to year and from one performance metric to another, so that there is not a disincentive to the NEOs. Payouts may exceed 100% if the performance exceeds 100% of the target objective as set forth in the table below. We believe that an “all or nothing” approach could provide a disincentive compared to our variable funding approach that is better aligned with our overall operating objectives, and ensures that pay varies in proportion to performance.

Historically, the Compensation Committee has established performance goals and the weighting of each goal during its first Compensation Committee meeting each year. The process for setting the goals begins with the management team establishing preliminary goals based on prior year’s results, the budget, strategic initiatives, industry performance and projected economic conditions. The Compensation Committee assesses the difficulty of the goals and their implications for share price appreciation, revenue growth and other related factors. The iterative process results in final goals presented by management to the Compensation Committee at its March meeting.

The table below sets forth the percentages of the portion of the Fiscal 2020 annual incentive bonus that was payable upon achievement of the minimum, target and maximum levels (with interpolation between levels) of the performance metrics set forth in the table below for each of our NEOs.

| Performance Metric | | Attainment Range (Minimum/

Target/

Maximum) | | Payout Percentage

(Minimum/

Target/

Maximum) | | Clark | | Burns | | Ball | | Saville | | White |

| Company Annual Revenue | | 95%/100%/105% | | 20%/100%/180% | | 20% | | 20% | | 20% | | 20% | | 20% |

| Company Annual Adjusted EBITDA | | 80%/100%/120% | | 20%/100%/180% | | 60% | | 60% | | 60% | | 60% | | 60% |

| Individual Objectives | | n/a | | 20%/100%/180% | | 20% | | 20% | | 20% | | 20% | | 20% |

| | | | | | | | | | | | | | | |

Totals | | | | | | 100% | | 100% | | 100% | | 100% | | 100% |

Company annual Adjusted EBITDA (a non-GAAP financial measure) and Company annual revenue targets for the NEOs for 2020 were $31.3 million and $860.0 million, respectively. See Annex A of this proxy statement for further discussion regarding how annual Adjusted EBITDA was calculated from our Consolidated Financial Statements and a reconciliation of annual Adjusted EBITDA to our results as reported under GAAP.

Determination of Fiscal 2020 Annual Incentive Bonus Payments

The Committee determined that, for Fiscal 2020, the Company achieved annual revenue of $836.4 million, equal to 97.3% of the target goal, and annual Adjusted EBITDA of $36.3 million, equal to 116.2% of the target goal. As a result of the attainment on the respective metrics, the payout percentages for annual revenue and Adjusted EBITDA were 56% and 165%, respectively. Additionally, our NEOs met most or all of their respective individual objectives associated with the subjective component. Resulting awards for our NEOs ranged from approximately 129% to 130% of target, as noted below, marking the first year since Fiscal 2015 that short-term incentives were near or above target award levels. In approving these awards, the Compensation Committee took into consideration our NEOs’ extraordinary efforts to protect, manage, and grow the business and seamlessly maintain operations during a time of tremendous uncertainty. However, no adjustments or discretion were applied to financial performance results to account for the impact of the COVID-19 pandemic.

| | | | Target Bonus

Opportunity | | Annual Incentive Bonus Earned |

| NEOs | | | % of Base Salary | | $ | | % of Target Bonus

Opportunity

Earned(1) | | $ |

| Kevin C. Clark | | | 100% | | 825,000 | | 129.3% | | 1,067,073 |

| William J. Burns | | | 70% | | 367,500 | | 130.1% | | 478,272 |

| Susan E. Ball | | | 75% | | 315,000 | | 130.1% | | 409,948 |

| Stephen A. Saville | | | 75% | | 322,500 | | 130.1% | | 419,708 |

| Buffy S. White | | | 75% | | 322,500 | | 130.1% | | 419,708 |

| (1) | | Based on achievement level of the Company’s financial performance with respect to the annual revenue and Adjusted EBITDA targets and the following achievement of individual objectives: 96% for Mr. Clark and 100% for each of Messrs. Burns and Saville, and Ms. Ball and Ms. White. |

The table below shows historic short-term bonus payouts:

Three-Year STI Bonus Payment History

| NEOs | | Year | | Target ($) | | Payout ($) | | Payout as

% of Target | |

| Kevin C. Clark | | 2020 | | 825,000 | | 1,067,073 | | 129.3 | % |

| | | 2019 | | 825,000 | | 368,915 | | 44.7 | % |

| | | | | | | | | | |

| William J. Burns | | 2020 | | 367,500 | | 478,272 | | 130.1 | % |

| | | 2019 | | 367,500 | | 164,335 | | 44.7 | % |

| | | 2018 | | 393,750 | | 63,000 | | 16.0 | % |

| | | | | | | | | | |

| Susan E. Ball | | 2020 | | 315,000 | | 409,948 | | 130.1 | % |

| | | 2019 | | 294,000 | | 131,468 | | 44.7 | % |

| | | 2018 | | 225,000 | | 45,000 | | 20.0 | % |

| | | | | | | | | | |

| Stephen A. Saville | | 2020 | | 322,500 | | 419,708 | | 130.1 | % |

| | | 2019 | | 322,500 | | 144,212 | | 44.7 | % |

| | | | | | | | | | |

| Buffy S. White | | 2020 | | 322,500 | | 419,708 | | 130.1 | % |

| | | 2019 | | 280,000 | | 186,128 | | 66.5 | % |

| | | 2018 | | 210,000 | | 37,800 | | 18.0 | % |

Long-Term Incentive Compensation

The Company uses equity-based awards to focus executives on long-term performance, to align executives’ financial interests with those of stockholders and to create retention platforms for key executives. Equity-based awards for NEOs are generally made based on the executive’s position, experience and performance, prior equity-based compensation awards and competitive equity-based compensation levels. Further, the Compensation Committee determines the terms and conditions of equity grants taking into account market practices and the objectives of the compensation program. Retaining key talent is a key factor for the Compensation Committee in considering the level of equity awards and the vesting schedule.

In 2020, 66.7% of the equity awards granted to the NEOs were in the form of time-based restricted share awards (RSAs) and 33.3% were in the form of performance-based share awards (PSAs) under our 2020 Omnibus Incentive Plan, as amended (the “Plan”). The Compensation Committee increased the weighting on PSAs (from 25% in Fiscal 2019 to 33.3% in Fiscal 2020) to further strengthen the alignment of NEO compensation with longer-term sustainable performance results. The Company issues PSAs to tie compensation to specific longer-term financial performance goals and focus management on maximizing stockholder value. In 2020, the total targeted long-term opportunities and mix for our NEOs is set forth in the following table:

| Name | | RSA Component

(66.7% Weighting in 2020) | | PSA Component

(33.3% Weighting in 2020) | | Total Target LTI Opportunity |

| $ Value | | % of Salary | | $ Value | | % of Salary | | $ Value | | % of Salary |

| Kevin C. Clark | | $ | | 1,512,500 | | 183.3 | % | | $ | | 756,250 | | 91.7% | | $ | | 2,268,750 | | 275.0 | % |

| William J. Burns | | $ | | 437,500 | | 83.3 | % | | $ | | 218,750 | | 41.7% | | $ | | 656,250 | | 125.0 | % |

| Susan E. Ball | | $ | | 280,000 | | 66.7 | % | | $ | | 140,000 | | 33.3% | | $ | | 420,000 | | 100.0 | % |

| Stephen A. Saville | | $ | | 215,000 | | 50.0 | % | | $ | | 107,500 | | 25.0% | | $ | | 322,500 | | 75.0 | % |

| Buffy S. White | | $ | | 215,000 | | 50.0 | % | | $ | | 107,500 | | 25.0% | | $ | | 322,500 | | 75.0 | % |

The Compensation Committee approves a number of RSAs and a target number of PSAs to be granted to the NEOs on March 31st of each year. The grant date values of the RSAs and PSAs granted in Fiscal 2020 are set forth below and were based on the closing price on the grant date. Individual awards are based on a percentage of individual’s respective base salary at the time the awards are granted. The percentages and eligibility are based on the terms of employment for certain individuals or as may be determined by the Compensation Committee.

| Name | | | Grant Date Value

of RSAs

(per share) | | Number

of RSAs | | Grant Date Value

of PSAs at Target

(per share) | | Target Number

of PSAs |

| Kevin C. Clark | | | $ | | 6.74 | | 224,519 | | $ | | 6.74 | | 112,092 |

| William J. Burns | | | $ | | 6.74 | | 64,944 | | $ | | 6.74 | | 32,424 |

| Susan E. Ball | | | $ | | 6.74 | | 41,564 | | $ | | 6.74 | | 20,751 |

| Stephen A. Saville | | | $ | | 6.74 | | 31,916 | | $ | | 6.74 | | 15,934 |

| Buffy S. White | | | $ | | 6.74 | | 31,916 | | $ | | 6.74 | | 15,934 |

All of the RSAs granted to the NEOs in 2020 provide for vesting of 33.33% of the award on each of the first, second and third anniversaries of the grant date, subject to the NEO’s continued employment through the vesting date.

The PSAs granted to the NEOs in 2020 provide for the issuance of a number of shares based on the level of attainment of cumulative Adjusted EBITDA (a non-GAAP financial measure) over a three-year period (weighted 75%) and the Adjusted EBITDA margin at the end of that three-year period (weighted 25%) as follows:

| Performance Level | | 3-yr Cumulative Adjusted EBITDA Achieved ($000s) | | Percentage of the Target Shares Earned | | Adjusted EBITDA Margin Achieved | | Percentage of the Target Shares Earned |

| Below Threshold | | Less than $110,000 | | 0% | | Less than 6.50% | | 0% |

| Threshold | | $110,000 | | 20% | | 6.50% | | 20% |

| Target | | $146,700 | | 100% | | 7.00% | | 100% |

| Maximum | | $161,300 | | 120% | | 7.50% | | 120% |

The PSAs granted to the NEOs in 2020 will vest, if at all, on or about March 31, 2023, subject to the achievement of the applicable performance goals and the NEOs’ continued employment through such date. The performance stock awards that were granted in 2018 were not earned and, accordingly, those shares have been forfeited. See Annex A of this proxy statement for a reconciliation of non-GAAP financial measures to our results as reported under GAAP.

OTHER COMPENSATION AND BENEFITS

Nonqualified Deferred Compensation Plans

We maintain the 2003 Deferred Compensation Plan and the 2017 Nonqualified Deferred Compensation Plan, each an unfunded non-qualified deferred compensation arrangement, intended to comply with Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”).

Under the deferred compensation plans, designated employees, including our NEOs, may elect to defer the receipt of a portion of their annual base salary, bonus and commission to our deferred compensation plans. We may also make a discretionary contribution to the deferred compensation plans on behalf of certain participants. Discretionary contributions to the 2003 Deferred Compensation Plan generally become vested three years from the date such contribution is made to the plan, upon the occurrence of a change in control or upon a participant’s retirement, death during employment or disability. Discretionary contributions to the 2017 Nonqualified Deferred Compensation Plan are subject to such vesting period as determined by the Company at the time of the contribution. Generally, payments under the deferred compensation plans automatically commence upon a participant’s retirement, termination of employment or death during employment. Under certain limited circumstances described in the deferred compensation plans, participants may receive distributions during employment. To enable us to meet our financial commitment under the deferred compensation plans, assets may be set aside in a corporate-owned vehicle, which assets remain available to all our general creditors in the event of our insolvency. Participants of the deferred compensation plans are our unsecured general creditors with respect to the deferred compensation plan benefits.

401(k) Plan and Other Benefits

We maintain a 401(k) plan. The plan permits eligible employees to make voluntary, pre-tax contributions to the plan up to a specified percentage of compensation, subject to applicable tax limitations. We may make a discretionary matching contribution to the plan equal to a pre-determined percentage of an employee’s voluntary, pre-tax contributions and may make an additional discretionary profit sharing contribution to the plan, subject to applicable tax limitations. Our NEOs are eligible for matching contributions, subject to regulatory limits on contributions to 401(k) plans. Eligible employees who elect to participate in the plan are generally vested in any matching contribution after three years of service with us and fully vested at all times in their employee contributions to the plan. The plan is intended to be tax-qualified under Section 401(k) of the Code, so that contributions to the plan and income earned on plan contributions are not taxable to employees until withdrawn from the plan, and so that our contributions, if any, will be deductible by us when made. In addition to the 401(k) plan, we provide our NEOs with health and dental coverage, company-paid group term life insurance, disability insurance, paid time off and paid holidays programs applicable to other employees in their locality. These benefits are designed to be competitive with overall market practices and are in place to attract and retain the necessary talent in the business.

Employment Agreements

Mr. Clark, CEO and President

On January 16, 2019, the Board theyappointed Kevin Clark as our President and Chief Executive Officer. We entered into an employment agreement (the “Clark Agreement”) with Mr. Clark with an initial term expiring on December 31, 2021, subject to automatic renewal for successive one-year terms unless prior to the end of the initial term or any renewal term either party has given at least 90 days’ prior written notice of the intention not to renew the Clark Agreement. The Clark Agreement provides for Mr. Clark to receive an annual base salary of $825,000. Mr. Clark’s base salary will be reviewed for increase on an annual basis by the Board or the Compensation Committee. For each calendar year during the term, Mr. Clark is eligible to participate in the Company’s annual bonus plan with a target bonus of 100% of his base salary, based on achieving performance goals to be established by the Compensation Committee. In addition, for each calendar year during the term, Mr. Clark is eligible to participate in the Company’s long term incentive plan and receive awards valued at 275% of his base salary. Such awards will be upon terms and conditions determined by the Compensation Committee. Mr. Clark is also eligible to participate in all other benefit plans and fringe benefit arrangements available to the Company’s senior executives.

If Mr. Clark’s employment is terminated by the Company without cause (as defined in the Clark Agreement) or if Mr. Clark terminates his employment for good reason (as defined in the Clark Agreement), subject to his execution of a release, he will be entitled to a severance payment equal to the sum of (i) two years of his base salary plus (ii) an amount equal to two times the bonus Mr. Clark would have earned during the year in which such termination occurs (such amount to be determined by the Compensation Committee). In addition, all then-current benefits will continue for a period of two years and all unvested stock appreciation rights, performance stock awards, stock options or other equity awards will immediately vest. If Mr. Clark’s employment is terminated because the Company has given Mr. Clark notice of non-renewal, he will be entitled to a non-renewal payment equal to 18 months of his base salary.

During Mr. Clark’s employment and for a period of two years thereafter, Mr. Clark may not compete with the Company in any jurisdiction in which the Company’s business is conducted nor may he intentionally interfere with the Company’s relationship with any of its suppliers, customers or employees.

Mr. Burns, Executive Vice President and Chief Financial Officer

On February 1, 2019, the Company amended its employment agreement with William J. Burns to appoint him as its Executive Vice President and Chief Financial Officer. Mr. Burns previously served as the Company’s Chief Operating Officer from January 25, 2018 to February 1, 2019 and as the Company’s Chief Financial Officer since April 2013 to January 2018. His base salary is $525,000 per year and remains subject to annual review by the Compensation Committee. Effective February 22, 2021, he is eligible to participate in the Company’s annual bonus plan with a target bonus of 75% of his base salary, based on achieving performance goals to be established by the Compensation Committee. Mr. Burns is also eligible to participate in the Company’s long term incentive plan and receive awards valued at 125% of his base salary based on the

level of achievement of performance goals as Chief Financial Officer to be established by the Compensation Committee.

Mr. Burns is eligible to participate in the Company’s equity incentive plan, as well as all benefit plans and fringe benefit arrangements available to our senior executives. If Mr. Burns’ employment is terminated by us without cause or Mr. Burns terminates his employment for good reason, and if he is not otherwise entitled to receive severance benefits under our Executive Severance Plan Amended and Restated as of May 28, 2010 (“Executive Severance Plan”), subject to his execution of a release, he will be entitled to a severance payment equal to one year’s base salary and health insurance benefits.

During Mr. Burns’ employment and for a period of two years thereafter, Mr. Burns may not compete with the Company in any jurisdiction in which the Company’s business is conducted nor may he intentionally interfere with the Company’s relationship with any of its suppliers, customers or employees.

Ms. Ball, Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary

Ms. Ball joined the Company as its Corporate Counsel pursuant to the terms and conditions of an offer letter entered into in March 2002 (the “Ball Offer Letter”). Her base salary is reviewed for increase on an annual basis by the Board or the Compensation Committee. For each calendar year during the term, Ms. Ball is eligible to participate in the Company’s annual bonus plan with a target bonus of 75% of her base salary, based on achieving performance goals to be established by the Compensation Committee. In addition, for each calendar year during the term, Ms. Ball is eligible to participate in the Company’s long term incentive plan and receive awards valued at 100% of her base salary. Such awards are based upon terms and conditions determined by the Compensation Committee. Ms. Ball is also eligible to participate in all other benefit plans and fringe benefit arrangements available to the Company’s senior executives.

Most recently, the Company amended the Ball Offer Letter on February 22, 2021, to increase her base salary from $420,000 to $430,000 and to change her title to include Chief Administrative Officer.

In addition to increasing her base salary and changing her title, if Ms. Ball’s employment is terminated by the Company without cause (as defined in the offer letter) or if Ms. Ball terminates her employment for good reason (as defined in the offer letter) she will be entitled to a severance payment equal to the sum of: (i) any unpaid base salary through the date of termination; (ii) reimbursement for unreimbursed business expenses incurred through the termination date; (iii) payment of unused vacation and sick time in accordance with the Company’s policy; and (iv) all other applicable compensation arrangement or benefit, equity or fringe benefit plan or program or grant pursuant to the terms and conditions of such plans; and continued payments of base salary in effect at the time of termination in accordance with the Company’s regular payroll practices for a period of twelve months following the date of termination (the “Severance Payments”).

Ms. Ball is entitled to participate in the Company’s Executive Severance Plan; provided, however, that if she is or becomes eligible to receive severance benefits under such plan, she

will cease to be eligible for severance payments under her offer letter described above and the Company’s sole obligation will be to pay her the amounts and benefits provided in the Executive Severance Plan subject to the terms and conditions thereof.

During Ms. Ball’s employment and for a period of one year thereafter, she may not, among other things, compete with the Company in any jurisdiction in which the Company’s business is conducted nor may she intentionally interfere with the Company’s relationship with any of its suppliers, customers or employees.

Mr. Saville, Group President, Locums, Education and Corporate Development

Mr. Saville joined the Company on April 15, 2019 as its Executive Vice President of Operations pursuant to the terms and conditions of an offer letter entered into on March 11, 2019 (the “Saville Offer Letter”). On January 25, 2021, his title was changed to Group President, Locums, Education and Corporate Development. The Saville Offer Letter provides for Mr. Saville to receive an annual base salary of $430,000. Mr. Saville’s base salary will be reviewed for increase on an annual basis by the Board or the Compensation Committee. For each calendar year during the term, Mr. Saville is eligible to participate in the Company’s annual bonus plan with a target bonus of 75% of his base salary, based on achieving performance goals to be established by the Compensation Committee. In addition, for each calendar year during the term, Mr. Saville is eligible to participate in the Company’s long term incentive plan and receive awards valued at 75% of his base salary. Such awards will be upon terms and conditions determined by the Compensation Committee. Mr. Saville is also eligible to participate in all other benefit plans and fringe benefit arrangements available to the Company’s senior executives.

If Mr. Saville’s employment is terminated by the Company without cause (as defined in the offer letter) or if Mr. Saville terminates his employment for good reason (as defined in the offer letter) he will be entitled to a severance payment equal to the sum of; (i) any unpaid base salary through the date of termination; (ii) reimbursement for unreimbursed business expenses incurred through the termination date; (iii) payment of unused vacation and sick time in accordance with the Company’s policy; and (iv) all other applicable compensation arrangement or benefit, equity or fringe benefit plan or program or grant pursuant to the terms and conditions of such plans; and continued payments of base salary in effect at the time of termination in accordance with the Company’s regular payroll practices for a period of twelve months following the date of termination (the “Severance Payments”).

Mr. Saville will be entitled to participate in the Company’s Executive Severance Plan; provided, however, that if he is or becomes eligible to receive severance benefits under such plan, he will cease to be eligible for Severance Payments and the Company’s sole obligation will be to pay him the amounts and benefits provided in the Executive Severance Plan subject to the terms and conditions thereof.

During Mr. Saville’s employment and for a period of one year thereafter, he may not, among other things, compete with the Company in any jurisdiction in which the Company’s business is conducted nor may he intentionally interfere with the Company’s relationship with any of its suppliers, customers or employees.

Ms. White, Group President Workforce Solutions

On March 27, 2020, the Company amended Ms. White’s original offer letter to increase her base salary from $400,000 to $430,000 and increase her annual cash incentive bonus eligibility from 70% of her base salary to 75% (based on achieving performance goals to be established by the Compensation Committee). On January 25, 2021, her title was changed to Group President, Workforce Solutions. Ms. White’s base salary will be reviewed for increase on an annual basis by the Board or the Compensation Committee. In addition, for each calendar year during the term, Ms. White is eligible to participate in the Company’s long term incentive plan and receive awards valued at 75% of her base salary. Such awards will be upon terms and conditions determined by the Compensation Committee. Ms. White is also eligible to participate in all other benefit plans and fringe benefit arrangements available to the Company’s senior executives.

Pursuant to Ms. White’s addendum to her original offer letter with the Company entered into on May 21, 2019, if Ms. White’s employment is terminated by the Company without cause (as defined in the offer letter) or if Ms. White terminates her employment for good reason (as defined in the offer letter) she will be entitled to a severance payment equal to the sum of: (i) any unpaid base salary through the date of termination; (ii) reimbursement for unreimbursed business expenses incurred through the termination date; (iii) payment of unused vacation and sick time in accordance with the Company’s policy; and (iv) all other applicable compensation arrangement or benefit, equity or fringe benefit plan or program or grant pursuant to the terms and conditions of such plans; and continued payments of base salary in effect at the time of termination in accordance with the Company’s regular payroll practices for a period of twelve months following the date of termination (the “Severance Payments”).

Ms. White will be entitled to participate in the Company’s Executive Severance Plan; provided, however, that if she is or becomes eligible to receive severance benefits under such plan, she will cease to be eligible for severance payments under her offer letter described above and the Company’s sole obligation will be to pay her the amounts and benefits provided in the Executive Severance Plan subject to the terms and conditions thereof.

During Ms. White’s employment and for a period of one year thereafter, she may not, among other things, compete with the Company in any jurisdiction in which the Company’s business is conducted nor may she intentionally interfere with the Company’s relationship with any of its suppliers, customers or employees.

Severance/Change of Control Arrangements

We maintain an Executive Severance Plan pursuant to which, subject to executing a release, each NEO is entitled to receive certain severance payments and benefits if, within 90 days prior to, or within 18 months after, a “Change of Control” (as defined in the Executive Severance Plan) of the Company, such NEO is terminated without cause or incurs an “involuntary termination” (i.e. a resignation for good reason). It is a “double-trigger” policy as a “Change of Control” must occur and the NEO must be terminated without Cause (as defined in the Executive Severance Plan) or the NEO terminates for “Good Reason” (as defined in the Executive Severance Plan).

Under the Executive Severance Plan, Mr. Clark, Mr. Burns, and Ms. Ball are entitled to receive continued base salary for a period of two years following termination, plus two times the amount of their target bonus for the year in which a Change of Control occurs; and Mr. Saville and Ms. White are entitled to receive continued base salary for a period of one year following termination, plus one times the amount of their target bonus of the year in which a Change of Control occurs. In addition, during such period, we would continue to make group health, life or other similar insurance plans available to such NEO and his or her dependents, and we would pay for such coverage to the extent we paid for such coverage prior to the termination of employment. The severance benefits payable under the Executive Severance Plan are subject to the execution of a release and reduction to avoid any excise tax on “parachute payments” if the NEO would benefit from such reduction as compared to paying the excise tax.

Under our general severance pay policy for all of our eligible employees, if an NEO (other than Mr. Clark and Mr. Burns whose arrangements are included in their employment agreements and Mr. Saville and Ms. White whose arrangements are included in their offer letters) is terminated without cause (as defined in our general severance pay policy) other than in connection with a Change of Control, the NEO, subject to executing a release would be entitled to one week’s base salary for each full accessyear of continuous service with us.

Perquisites

Our NEOs are not entitled to any perquisites that are not otherwise available to all of our books, recordsemployees. In this regard, it should be noted that we do not provide defined benefit pension arrangements, post-retirement health coverage or similar benefits for our executives or employees.

Anti-Hedging Policy

Pursuant to our Securities Compliance Policy and reports;

��

��